Brief History

Mission

Goals

Objectives

- Be able to analyze and explain business financial position and operating performance.

- Be able to prepare financial statement according to generally accepted accounting principles and file personal and corporate income tax returns according to tax codes.

- Be able to do cost analysis, budget planning, and performance evaluation.

- Be able to identify the causes and consequences of accounting issues, collect and analyze accounting data, and finally write and present the accounting research project.

- Be familiar with accounting cycles and accounting system under e-commerce.

- Be equipped with communicating and coordinating capability.

Developments/Accomplishments

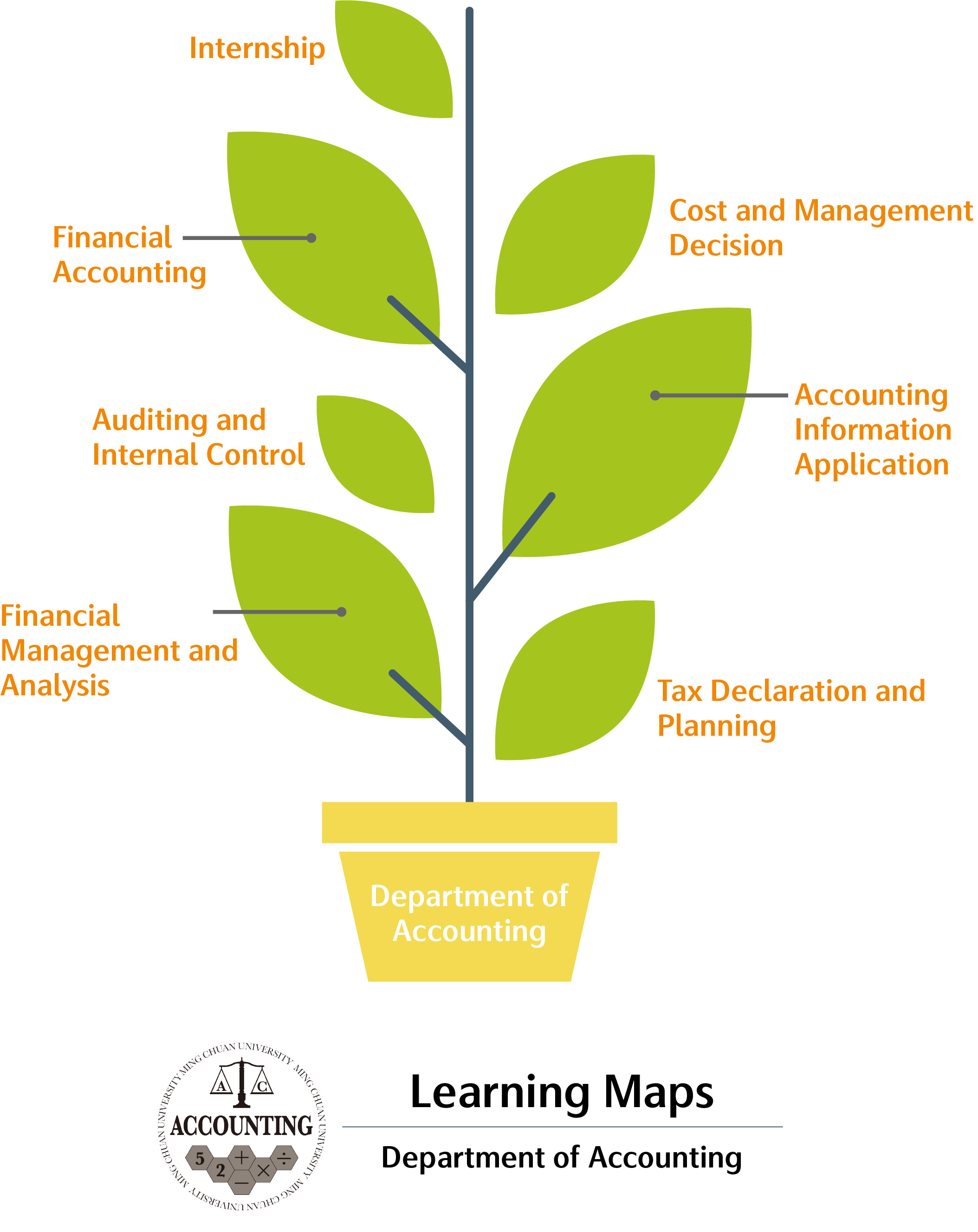

In compliance with the accounting job market trends and the developments of computer technology, the department focuses on areas as follows:

- Professional Taxation

The major courses include: Tax Law and Accounting, Tax Planning, Practice of Tax Declaration, Accounting and Tax Filing Practice, Bookkeeping Laws, Accounting and Auditing Regulations, Commercial Law, Accounting Practice Lectures. - Finance Regulations

The major courses include: Commercial Law, Corporate Law, Security Law, Financial Regulations, Corporate Governance Regulations, Enterprises Mergers and Acquisitions Act. - Management Accounting

The major courses include: Cost and Management Accounting, Financial Management, Strategic Cost Management, Supply Chain Management, Performance Management, Management Decision Analysis, Customer Relationship Management. - Accounting Information Systems

The major courses include: Accounting Information Systems, Enterprise Resource Planning, Computer Audit. - Internship

The course provides students intern jobs in corporations and accounting firms during semester and summer vacation. Many students are also offered opportunities to continue to work in the corporations where they interned after graduation.

Features

Future Prospects For Graduates

An accounting degree opens up a wide variety of exciting and well-paid careers. All organizations in all countries require accounting services. The prospects for graduates from our department include:

- Auditor, management consulting, computer auditor of accounting firm.

- Attorney affairs officer for public office, accounting, auditing, taxation and administrative staff.

- Business financial management and internal audit staff.

- Government officials in accounting and auditing.

- Obtain professional certification—CPA (Certified Public Accountant), CIA (Certified Internal Auditor), CMA (Chartered Management Accountant), CFA (Chartered Financial Analyst), and CFE (Certified Fraud Exam).

Our department is in close contact with major accounting firms in Taiwan. We organize visits for students to understand their future work environment. Internships and professional training are provided to senior students every academic year. Students graduating from our department perform quite well as accounting professionals, not only in major accounting firms, but also in governmental offices and other businesses and organizations.