Basic Core Competencies

Service-Learning, English proficiency, Information Technology proficiency, Chinese proficiency, and Sports capability.

Undergraduate: Fundamental knowledge and skills in accounting, Capability to complete graduation project in accounting

Graduate: Capability to complete master’s thesis in accounting.

|

Undergraduate Program |

Assessment Methods |

|

1. Capable of analyzing, reporting, and interpreting business activities. |

Intermediate Accounting |

|

2. Capable of comprehending and applying accounting and auditing standards in international business contexts. |

Seminar on Accounting Profession under Globalization and Internship |

|

3. Be able to do cost analysis, budget planning, and performance evaluation |

Cost and Managerial Accounting and Strategic Cost Management |

|

4. Be able to identify the causes and consequences of accounting issues, collect and analyze accounting data, and finally write and present the accounting research project |

Senior Project (Rubric) |

|

5. Be familiar with accounting cycles and accounting system under e-commerce |

TQC (certificates) |

|

6. Be aware of professional ethics and be equipped with communicating and coordinating capability |

Seminar on Accounting Ethics and Senior Project (Rubric) |

|

Graduate Program |

Assessment Methods |

|

1. Advanced knowledge of accounting application capacity |

Theory of Financial Accounting (Rubric) |

|

2. Policy formulation and implementation capacity in the international environment |

Seminar on Financial Accounting |

|

3. Analysis, research and reporting capabilities of accounting issues |

Master's Thesis (Rubric) |

|

4. Planning and application capabilities of accounting and information systems |

Financial Information Processing and Analysis |

|

5. Capabilities of coordination and communication with team execution in the occupational environment |

Business and Accounting Ethics |

Fundamental Professional Competence Standards

MING CHUAN UNIVERSITY ENFORCEMENT RULES FOR ACCOUNTING DEPARTMENT FUNDAMENTAL PROFESSIONAL COMPETENCE STANDARDS

Passed at the Department Affairs Committee Meeting on March 19, 2010

Passed at the School Affairs Committee Meeting on May 17, 2010

Revised and passed at the Academic Affairs Committee Meeting on June 3, 2010

1. In accordance with the Ming Chuan University Procedures for Proficiency-based Graduation Requirements, these regulations were established to improve students’ competitiveness for their future careers and further studies.

2. To attain graduation eligibility, undergraduate students must meet the graduation requirements specified in these procedures and the enforcement rules for Service-Learning, English proficiency, Information Technology proficiency, Chinese proficiency and Sports capability, as well as the professional competencies stated in these regulations. Graduate students must meet the graduation requirements for professional competency stated in these regulations.

3. Students are required to meet the professional competencies outlined below during their period of study.

|

Degree Program |

Professional Competency |

Requirements |

|

Undergraduate |

Fundamental knowledge and skills in accounting |

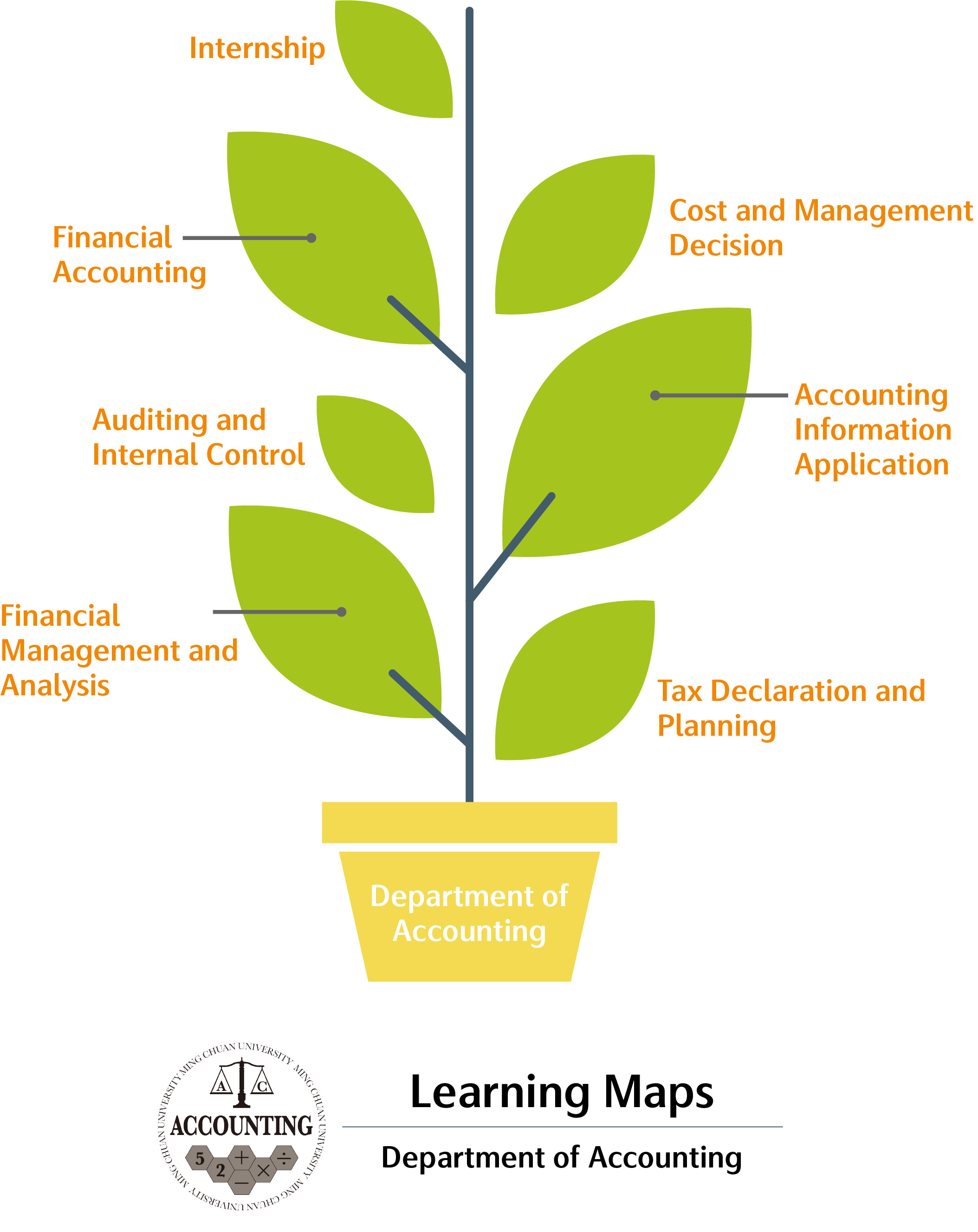

Students must at least pass 1 focused program offered by School of Management or complete 2 learning maps. At least one certificate in one of the following fields must be earned: accounting, taxation, finance, or enterprise resource planning. |

|

Capability to complete graduation project in accounting |

Student must complete and pass review of a graduation project in accounting. |

|

|

Graduate |

Capability to complete master’s thesis in accounting |

Student must complete and pass review of a master’s thesis and present one paper at a domestic or international conference. |

4. Students who fail to meet the requirements for professional competencies must enroll in and pass the remedial courses assigned by the Department to attain graduation eligibility (or other remedial measures).

5. Students who meet the graduation requirements for these professional competencies should submit relevant certificates or score reports to the Accounting Department. After completion of these procedures, the students will be verified as meeting the graduation requirements.

6. Upon being passed at the Department/School/Academic Affairs Committee Meetings and approved by the president, the enforcement rules were implemented. Any revision must follow the same procedures.

Course Requirements for Minor

|

Courses Required for Minor |

Credits |

Notes |

|

Intermediate Accounting I |

3 |

1. Prerequisite: Students need to pass the Accounting courses. 2. Students need not to re-take the same course(s) listed in this course outline if the course(s) is required by the department they major in but such course(s) cannot be waived. The chair of Department of Accounting will designate a related course(s) as a substitute. If there are any adjustments to the course(s), the chair will make further course(s)-substitute designation. 3. Students need to complete 7 disciplines, 21 course credits in total. |

|

Intermediate Accounting II |

3 |

|

|

Cost and Managerial Accounting I |

3 |

|

|

Cost and Managerial Accounting II |

3 |

|

|

Tax Law |

3 |

|

|

Auditing I |

3 |

|

|

Auditing II |

3 |

|

|

Total |

21 |

Course Requirements For Focused Program

ENFORCEMENT RULES FOR THE MANAGERIAL ACCOUNTING COURSE PROGRAM

OF THE MANAGEMENT SCHOOL AT MING CHUAN UNIVERSITY

Passed at the Department Affairs Committee Meeting on November 29, 2019

Passed at the Academic Affairs Committee Meeting on May 14, 2020

Article 1. To cultivate professional management talent with knowledge in modern management accounting and business management, this school formulated the Enforcement Rules for the Taxation and Finance Law Course in accordance with the Procedures for Establishing Cross-school, Cross-department, and Cross-disciplinary Degree and Course Programs.

Article 2. The course committee shall consist of 4 members from relevant departments in this college. One member shall be elected as the convener by the members of the committee. The course committee is responsible for planning the course curriculum.

Article 3. The unit responsible for this course is the Department of Accounting of the School of Management.

Article 4. The required courses and credit hours of this course shall be implemented after being passed by relevant curriculum committees and the Academic Affairs Committee Meeting and approved by the president.

Article 5. All undergraduate students of Ming Chuan University may apply for this program through the MCU Student Information System and be admitted upon approval.

Article 6. Students must complete at least 20 credits, of which at least 6 credits shall come from departments outside of the student’s major and minor. After the completed credits are confirmed and then reported to and approved by the president, the University shall issue a course certificate.

Article 7. With the exception of students in the Teacher Education Program, who are eligible to extend their study period in accordance with regulations outlined in the Procedures for Establishing Teacher Education Centers, students that take this course and meet the requirements for graduation in their original department or graduate program but have not completed the credits required for the program may not extend the number of years required for graduation as outlined in the University Act.

Article 8. This course will be evaluated regularly by the School of Management, the evaluation standards including the numbers of students applying and certificates obtained and the level of student satisfaction. Adjustments or termination of the course shall be made according to the evaluation results.

Article 9. Matters not covered in these Rules will be dealt with in accordance with the General Provisions for Study of the University and other relevant regulations.

Article 10. These Rules and any revisions shall be promulgated and implemented after being passed by the Department Affairs Committee Meeting, the School Affairs Committee Meeting, and the Academic Affairs Committee Meeting and approved by the president.

ENFORCEMENT RULES FOR THE TAXATION AND FINANCE LAW COURSE PROGRAM

OF THE MANAGEMENT SCHOOL AT MING CHUAN UNIVERSITY

Passed at the Department Affairs Committee Meeting on November 29, 2019

Passed at the Academic Affairs Committee Meeting on May 14, 2020

Article 1. To cultivate taxation and business law talent with knowledge in business law, taxation, securities, and finance, this school formulated the Enforcement Rules for the Taxation and Finance Law Course in accordance with the Procedures for Establishing Cross-school, Cross-department, and Cross-disciplinary Degree and Course Programs.

Article 2. The course committee shall consist of 4 members from relevant departments in this college. One member shall be elected as the convener by the members of the committee. The course committee is responsible for planning the course curriculum.

Article 3. The unit responsible for this course is the Department of Accounting of the School of Management.

Article 4. The required courses and credit hours of this course shall be implemented after being passed by relevant curriculum committees and the Academic Affairs Committee Meeting and approved by the president.

Article 5. All undergraduate students of Ming Chuan University may apply for this program through the MCU Student Information System and be admitted upon approval.

Article 6. Students must complete at least 20 credits, of which at least 6 credits shall come from departments outside of the student’s major and minor. After the completed credits are confirmed and then reported to and approved by the president, the University shall issue a course certificate.

Article 7. With the exception of students in the Teacher Education Program, who are eligible to extend their study period in accordance with regulations outlined in the Procedures for Establishing Teacher Education Centers, students that take this course and meet the requirements for graduation in their original department or graduate program but have not completed the credits required for the program may not extend the number of years required for graduation as outlined in the University Act.

Article 8. This course will be evaluated regularly by the School of Management, the evaluation standards including the numbers of students applying and certificates obtained and the level of student satisfaction. Adjustments or termination of the course shall be made according to the evaluation results.

Article 9. Matters not covered in these Rules will be dealt with in accordance with the General Provisions for Study of the University and other relevant regulations.

Article 10. These Rules and any revisions shall be promulgated and implemented after being passed by the Department Affairs Committee Meeting, the School Affairs Committee Meeting, and the Academic Affairs Committee Meeting and approved by the president.

Course Structure For Taxation And Finance Law Course Program